Important Topics

ACCA EXAM Tips March 2024 Important Topics

PM EXAM Tips (Performance Management)

- Activity-Based Costing

- Throughput Accounting

- Variance Analysis

- Linear Programming

- CVP

- Pricing

- Risk and Uncertainty

- Performance Management

TX EXAM Tips (Uk Taxation)

- Individual Income Tax along with Partnership

- Corporate Tax

- Vat

- Inheritance Tax

- CGT

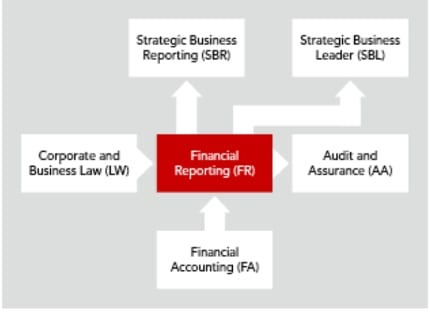

FR EXAM Tips (Finance Reporting)

- Consolidation

- Final accounts

- Ratio

- MCQs can be from anywhere

Questions to practice Final Accounts

- PRICE WELL

- XTOL

- KANDY

- TRIAGE

Questions to practice Consolidation

- POLESTAR

- PENKETH

- PELISTAR

- DARGENT

- LAUREL

Important Questions to practice Ratios & Cash-flow

- HARDY

- PINTO

- BENGAL

- FUNJECT

- MOWAIR

AA EXAM Tips (Audit and Assurance)

- Ethic

- Corporate governance

- Reporting

- Internal Controls (sales, Payroll, Purchases)

- Substantive Procedures (Cash cycle, revenue, and fixed asset)

FM Exam Tips (Financial Management)

- Investment appraisal

- The weighted average cost of capital

- Forex

- Sources of Finance

- Working Capital

SBL EXAM Tips (Strategic Business Leader)

- PESTEL

- Porter 5 Forces

- Human Resources

- Swot Analysis

- SFA Model

- Value Chain

- E . business, E-Marketing

- BCG Matrix

- Financial Information

- Internal Controls

- Corporate Governance

- Pestel/P5F/ Str Position

- Swot/Tows

- Corporate Portfolio

- Growth Strategies

- Culture

- E-Business / 61/ 7P

- IT Risk / Security / Cloud

- Harmon Process Matrix

- Context Change

- Outsourcing/ shared services

- Financial Proj/ Analysis

- Stakeholder/ Mendelow

- Prof/ Ethical behavior

- Agency / Conflict of Interest

- NEDs/ Board Comm

- Family-owned business

- Integrated Rep/ 6 Capita

SBR EXAM Tips (Strategic Business Reporting)

- Consolidated cash flow statement

- consolidated income statement

- IAS 19

- IAS 37

- IFRS 8

- IFRS 10

- IFRS 16

- IFRS 15

- IFRS 13

- IAS 38

- Financial Instruments

APM EXAM Tips (Advanced Performance Management)

- ABC

- BCG Matrix

- Ash-ridge Model

- Performance management

- Corporate Failure

- HR

AAA EXAM Tips (Advanced Audit and Assurance)

- Business Risk and ROMM

- Audit Procedure

- Ethic and quality control

- Sufficiency and Appropriateness of audit evidence or matters

- Due Diligence

- Forex

- Audit report (Critical appraisal or matters)

- Current issue ED ISA540

However ACCA Exam Tips all are just guesses based on research and our Experience, Please do not ignore the other areas as well

See Also:

- How to pass ACCA AA (Audit and Assurance)

- ACCA AAA (Advanced Audit and Assurance)

- How to pass ACCA SBL (Tips And Techniques)

- ACCA Video Lectures

- Six Exam apps, Students Must have

- Exam Tips

Stay Connected: Facebook

interpolation