Ratio Analysis

Financial Ratio Analysis

Ratio Analysis Plays a key Roll to determine the business circumstance, here are few Ratios are given below.

In the examination, you will be asked to calculate and interpret the ratios used in analytical procedures at the audit planning stage and when collecting audit evidence. Ratios and comparisons can be used to identify where the accounts might be wrong or right, and where additional auditing effort should be the need to spent.

Calculating a ratio is an easy step, divide a number by another number, the calculations are so basic that they can be calculated using a spreadsheet.

The real skill is the interpretation of results and using that information to conduct out a better audit. Saying that a ratio has increased because the top line in the calculation has increased or the bottom line decreased is rather had no point, this is simply translating the calculation into words. the interpretation is another thing.

Gross Profit Margin: Gross profit/Sales Revenue x 100

Operating profit margin =Operating profit/Sales Revenue x 100

Return on capital employed (ROI) = Operating profit/ Capital employed x 100

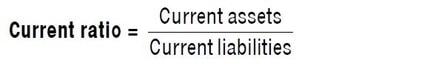

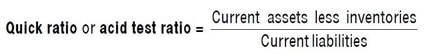

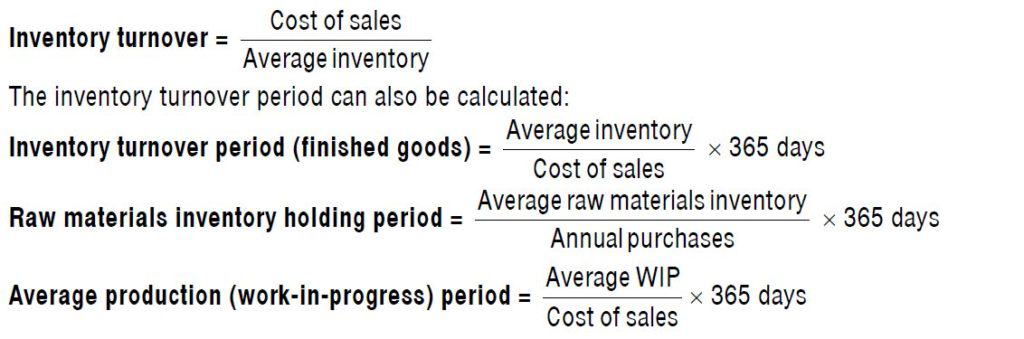

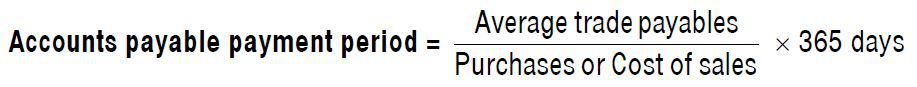

Working Capital Ratios

Interest cover = profit before interest/ interest

Gearing = Long-term loan finance/ equity finance x 100 The gearing ratio can also be defined

in other words, particularly by comparing long-term loan finance to total finance.

As the gearing ratio increases so risk that the interest can’t be paid. But it is difficult to define a

‘safe’ level of gearing. an example is, a property company with properties leased to tenants will have fairly rental income for one year.

Such a company can probably safely sustain substantial borrowings (though it could be in trouble if interest rates increased significantly).

A company with volatile streams of income would have to keep its gearing lower as it must ensure that they have the ability to pay interest during the lean times.

Read More: Analytical Procedures