Threats to Auditor Independence

International Code of Ethics for Professional Accountants ACCA AA & AAA

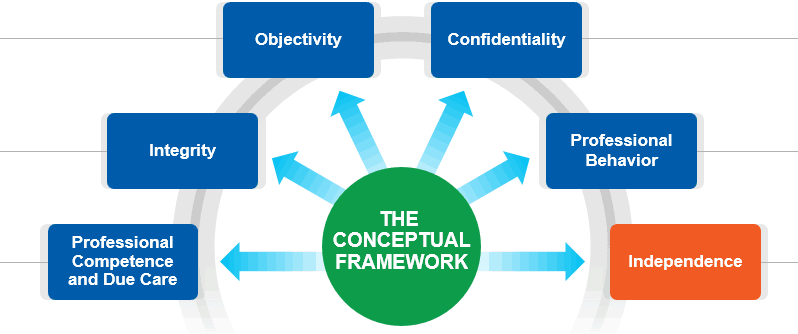

Conceptual Framework

What is Auditor Independence?

Auditors are expected to provide an unbiased opinion on the work that they have performed. An auditor who has a lack of independence or has threats to auditor independence, his audit report useless to those who rely on it.

For example, consider yourself a potential shareholder in XYZ Company. If you know that the auditor for XYZ Company keeps a personal relationship with the CEO of the company, would you trust that the audited work is a fair representation of the company’s financial standing? How can you be certain that the auditor and CEO did not influence issues a favorable audit report? so must ensure that Auditor no have Threats to Auditor Independence

Once you have identified a threat from the question scenario, you will need to name the threat, explain WHY it is a threat to the auditor and tell the safeguard for that threat.

Here are a few techniques that can be avoided Threats to Auditor Independence,

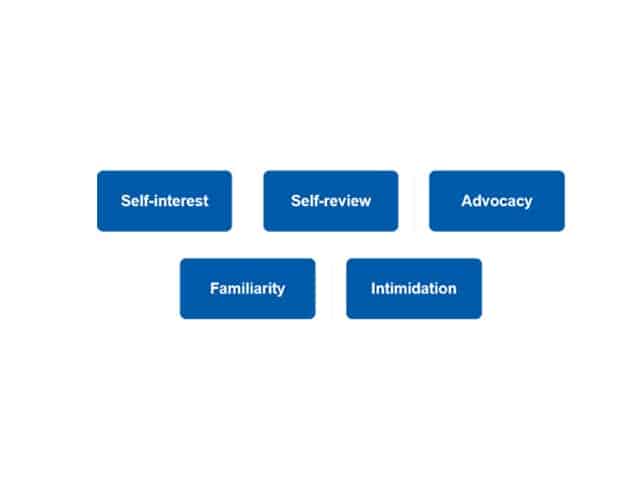

Threats to Auditor Independence?

In Audit, there are five threats that hurt the independence of the auditor. Before the start of an audit engagement, it is crucial that each member of the audit team independence. If an auditor is exposed to a certain threat, He/she should either develop safeguards to reduce the threat to an acceptable level or resign from audit engagement. here we are going to discuss threats to auditor independence and possible remedies

QCR: Quality Control Review ( independent partner review)- Having a professional accountant who was not involved with the non-assurance service review the non-assurance work performed

Chinese walls: The use of separate engagement teams, with different engagement partners and team members

Public interest entities are:

- (a) All listed entities; and

- (b) Any entity:

- Defined by regulation or law-making as a public interest entity

- OR

- For which the audit is required by law and regulation to be conducted in compliance with the same independence requirements that apply to the audit of listed entities. Such regulation may be circulated by any relevant regulator, including an audit regulator

1. Self interest threat and safeguards

The threat that a financial or other interest will inappropriately influence the auditor’s judgment or behavior.| Threat | Safeguard | |

|---|---|---|

| Direct financial interest | A member of the assurance team or the firm having a direct financial interest in the assurance client. | Remove the individual from the audit team the self-interest threat created would be so significant that no safeguards could reduce the threat to an acceptable level. |

| Gifts and hospitality | Nature, value and intent of offer to be considered Not allowed unless insignificant ( politely decline) | |

| Fee dependence | A firm having fee dependence on total fees from a client. | Listed clients: If gross recurring fee from one client greater than 15% of the firm’s revenue for two consecutive years,– Tell client’s BOD– Independent QCR or external QCR before OR After issuing 2nd year’s opinion Other clients:– Reducing the dependency on the client;– External quality control reviews OR Consulting a third party, such as a professional regulatory body (E.g ACCA, ICAEW) or a professional accountant on key audit judgments. |

| Recent Service with an Audit Client | If a member of the audit team has recently served an employee of the audit client | Remove from the team if worked at the client in the year being audited at a position to exact significant influence over the subject matter. |

| Close business relationship | A member of the assurance team (or the firm) having a significant-close business relationship – Commercial relationship, Common financial interest Examples: a joint venture with the client or a controlling owner/ director, formal marketing of each other’s product, combine the services of the firm with those being offered by the client and market the package. | If material, not allowed (The threat created would be so significant that no safeguards could reduce the threat to an acceptable level. |

| Contingency fee | Firm going to enter into a contingency fee arrangement relating to an assurance engagement | Politely decline the proposed contingent fee arrangement, Inform the client that the fees will be based on the level of work required to obtain sufficient and appropriate audit evidence. |

| Overdue fee | Might be regarded as being equivalent to a loan to the client if fees due from a client(Audit Client) remain unpaid for a long time, especially if a significant part is not paid before the issue of the audit report for the following financial year | Discuss with TCWG the reasons why the payments have not been made. Should agree with a revised payment method which will result in the fees being settled before much more work is performed for the current year audit |

| Loans and guarantee | If not under normal lending conditions, No safeguard acceptable under normal lending conditions- review by network firm. | |

| Serving as a Director or Officer of an Audit Client | Not allowed. (Particular reference made by the code to the role of the Company Secretary. If allowed under local laws or professional rules, the duties and activities shall be limited to those of a routine and nature of administrative, such as preparing minutes and maintaining statutory returns) | |

| Recruitment services (especially hiring of senior management) | Listed clients: Not allowed for directors or senior positions related to Financial Statements preparation. Otherwise, The final decision should be by the client and DO NOT negotiate on the client’s behalf firm can undertake roles such as reviewing a shortlist of other candidates. However, they must ensure that they are not interfering to undertake management decisions and so must not make the final decision on who is appointed |

|

| Employment negotiations with the audit client. | A member of the audit team entering into employment negotiations with the audit client. | Remove the individual from the audit team– A review of any significant judgments made by that individual while on the team |

| Compensation and Evaluation Policies | when a member of the audit team is evaluated on or compensated for selling non-assurance services to that client | Audit partner should not be evaluated on or compensated based on that partner’s success in selling non-assurance engagement to the partner’s audit client |

2. Self Review threat and safeguards

The threat that an auditor will not appropriately evaluate the results of a previous judgment made or service performed by himself.| Threat | Safeguards | |

|---|---|---|

| Self-Review | The threat that the auditor will not appropriately evaluate the results of a previous judgment made/or service performed by him | Provision of other services to an audit client (Note: other threats due to this are self-interest because of the fee element and advocacy Safeguard for Listed Clients: Most non-assurance services related to financial reporting are not allowed. Other clients: Segregation of duties, Chinese walls, QCR |

| Temporary staff assignments | The lending of staff by a firm to an audit client | Should ideally not be made a part of the audit team. Generally acceptable if no management responsibility is taken up and the audit client shall be responsible for directing and supervising the activities of the loaned staff |

| Recent Service with an Audit Client | a member of the audit team has recently served as an employee of the audit client- The threat is that the member of the audit team has to evaluate elements of the financial statements for which he had prepared the accounting records while with the client | Remove from the team if worked at the client in the year being audited at a position to exert significant influence over the subject matter |

3. Familiarity Threat and safeguards

The threat that due to a long or close relationship with a client or employer,| Threat | Safeguard | |

|---|---|---|

| Long Association | Long Association of Senior Personnel with an Audit Client | Listed clients: 7 years plus 1 year of flexibility than a gap of two years for audit partner– In these 2 years gap period, cannot participate in the audit Or provide quality control for the engagement, Or consult with the engagement team or the client regarding technical or industry-specific issues Other clients: Rotate members, & QCR |

| Family and Personal Relationships | Remove from the team if the relationship is with a senior person at the client with influence over the financial statements. | |

| Employment with an Audit Client | The director or a senior member of the audit client has been a member of the audit team or partner of the firm in the past | Listed client: for partners, ok if twelve months have passed since the individual was Partner. Other safeguards- Modifying the audit plan;-any work already undertaken by that individual should be independent reviewed.-Assigning individuals to the audit team who have enough experience in relation to the individual who has joined the client |

4. Advocacy Threat and safeguards

The threat that an auditor will promote a client’s or employer’s position to the point that the auditor objectivity is compromised.| Threat | Safeguard | |

|---|---|---|

| Legal services | Legal services To audit client ( For example contract support, litigation, mergers, and acquisition legal advice, and support to clients’ internal legal departments) | If they relate to resolving a dispute or litigation when the amounts involved are material to the Financial Statements: Not allowed |

| Promote client/shares | The auditor asked to promote client/shares in a client or asked to accompany the client to a meeting with the bank | Not allowed (Politely decline) |

5. Intimidation Threat and safeguards

The threat that an auditor will be deterred from acting objectively because of actual or perceived pressures, including attempts to exercise undue influence over the auditor.| Threat | Safeguard | |

|---|---|---|

| Threat of dismissal | Threat of dismissal or replacement of auditor/or his close family member over a disagreement about the application of an accounting principle. | Tell client’s TCWG– ensure that all audit engagements are conducted in accordance with International Standards on Auditing– Ensure you gather sufficient appropriate evidence *A dominant personality at the client attempting to influence the decision-making process, for example, the application of an accounting principle. *A firm being pressured to reduce inappropriately the extent of work performed in order to reduce fees. *An auditor feeling pressured to agree with the judgment of a client employee because the employee has more expertise on the matter in question. |

| Actual or Threatened Litigation | (For example regarding a previous audit report)- When the firm and the client’s management are placed in adversarial positions by actual or threatened legally, affecting management’s willingness to make complete disclosures | QCR– If a team member involved, remove from the – Withdraw from the cement if very significant |

| Fee dependence | Fee dependence, close personal relationships, business relationships also cause intimidation threats. | The safeguards for each will be the same as discussed earlier. |

6. Conflict of Interest Threat and safeguards

| Threat | Safeguard | |

|---|---|---|

| Firm competes with client or firm has a joint venture with a competitor of a client or the firm has competitors as clients | Members should place their clients’ interests before their own and should not accept or continue engagements which threaten to give rise to conflicts of interest between the firm and the client. Any advice given should be in the best interests of the company. | |

| A conflict of interest arises where an auditor acts for both a client company and for a competitor company of the client. Where the acceptance of an audit engagement would, despite safeguards, materially prejudice the interests of any clients, the appointment should not be accepted, or one of the appointments should be discontinued. | ||

| Where the acceptance of engagement would, despite safeguards, materially prejudice the interests of any clients, the appointment should not be accepted, or one of the appointments should be discontinued. | ||

| Managing conflicts of interest 1. Full disclosure is important – both companies should be fully aware that the firm is acting for the other party. 2. Regular review of the situation by an independent senior partner 3. Use of different partners and teams of staff for different engagements 4. Internal procedures within the firm -Procedures to stop access to information, for example, strict physical separation of both teams, private and secure data filing. -Clear guidelines for members of each assurance engagement team on issues of security and confidentiality. These guidelines must be included within the audit engagement letters. -Potentially the use of confidentiality agreements signed by employees and partners of the firm 5- Advising at least one or all clients to seek additional advice |

ACCA Past Papers Attempt These past papers questions to check your understanding:

- Sept/Dec Hybrid 2015-Q1

- June 2015-Q1

- June 2014-Q3d

- Dec 2013-Q4c

- June 2012-Q3b,c

This is the detailed explanation on Threats to Threats to Auditor Independence, and how its work, don’t forget to give us feedback by commenting below

Read More: How to Pass ACCA P7 AAA

Find Us on Facebook