Reasons for holding cash

Various reasons for holding cash, Discuss and apply the use of relevant techniques in Cash Management, Including

- Preparing a cash flow forecast to determine future cash flows and cash balances.

- Assessing the benefits of centralized treasury management and cash control.

- Cash management models, such as the Baumol Model and the Miller-Orr Model.

- Investing in the short term

Calculate the level of working capital investment in current assets and discuss the key factors determining this level, Including

- The length of the working capital cycle and terms of trade

- An organizations policy on the level of investment in current assets

- The industry in which the organization operates

Key factors in determining working capital funding strategies, Including

- The distinction between permanent and fluctuating current assets

- The relative cost and risk of short term and long term finance

- The matching principle

- The relative costs and benefits of aggressive, conservative, and matching funding policies

Key factors in determining working capital funding strategies, Including

- the distinction between permanent and fluctuating current assets

- The relative cost and risk of short term and long term finance

- The matching principle

- The relative cost and benefits of aggressive, conservative, and matching funding policies

- Management attitude to risk, Previous decisions,s and organization size

- Permanent Current assets: Which are used permanently in business

- Fluctuating Current asset: Aditional working capital which is needed in peak seasons, like in seasonal business need to change working capital, E.g Icecream Business

The Nature of Cash

Cash is King

- Cash is ready money in the bank Or in the business, unlikely inventory and receivables. it can be used to pay Wages, Rent, and suppliers.

- Having good profits does not necessarily mean that a business has enough cash.

- Monitoring cash inflows and outflows to ensure that there is enough cash is one of the most important management tasks for the business

- Ultimately it is a lack of cash when its needed that causes a business to fail

Reasons for Holding Cash

There are three reasons or motives for holding cash

- Transaction Motive: To meet the day to day transactions of running a business

- Precautionary Motive: As a safety net for unexpected events such as a large customer failure, An overdraft facility or line of credit will also provide this safety, Whatever you need to keep a little bit extra in the pocket

- Speculative Motive; To take advantage of opportunities. E.g Bulk buy discounts or investments in a new line of business when the opportunity arises. Like can pay suppliers to get the extra discount, Extra opportunities

Cash Flow Problems

Cash flow problems can arise for the following reason

- Making losses: This can eventually lead to failures.

- Inflation: Asset costs increase and will be expensive to replace.

- Growth: Cash is needed to provide inventory and fund receivables as the business grows (Overdrafting)

- One-Off item of expenditure: Foe example Tax, Dividends, Legal costs.

Cash Flow Forecasts

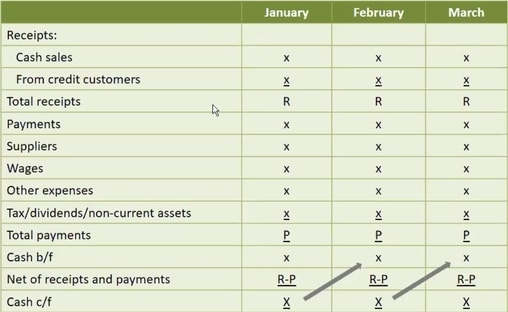

Cash flow forecasts or cash flow budgets are the key tool when managing cash.

- They should include both revenue and capital flows

- Careful attention needs to be paid to the timing of a receipt or payment

- They should be based on the budgeted statement of profit or loss and the statement of financial position.

- Essentially we are producing a bank statement in advance.

Cash Flow Forecasts- Timings

- Correct timings of receipts from customers and payments to suppliers are essential

- In the exam, these calculations are not difficult but they are repetitive, and initially, care is needed to get started correctly

- It is essential to provide clear workings both to help your accuracy and so that a member can follow what you have done

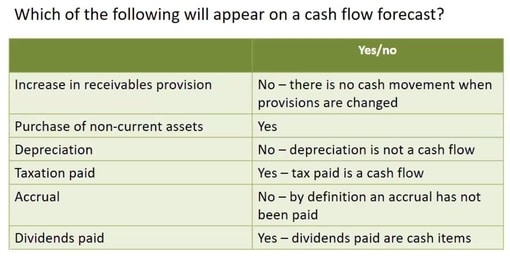

Not every aspect of the statement or profit or loss amount will have cash flow consequences. Similarly, some SOFP items will affect the cash flow forecast, Like in the table below some examples of Non-Csh items

Dealing with Cash Shortages

- Postpone capital expenditures

- Try to accelerate inflows (e.g Discounts)

- Take longer credit(but don’t upset suppliers)

- Re-Negociate loan payments

- Reduce or postpone dividend payments

- Liquidate inventory by having a sale

- Try to sell surplus assets, For example, sell vehicles to a fleet management company and rent them back (Lease and buyback)

- Finance- Re-schedule loan, Reduce dividends, Rais loan/equity finance if time allows

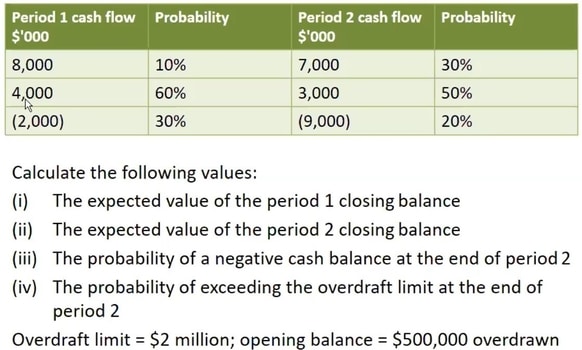

Cash Flow Forecast and Un-Certainty

- The cash flow forecast depends on estimating future Sales, Purchases, Cash receipts, and Cash payments

- These are inherently un-certain ) which Means sales can be next year 2M or 5M or 8M)

- Review cash forecasts regularly and use the latest and most accurate data available

- Examine the sensitivity of cash balance to assumptions about the timing and amount of cash flows

- Ensure sufficient contingent funds are available

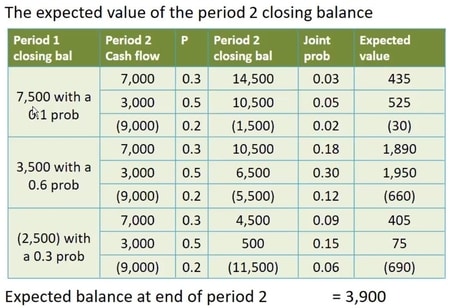

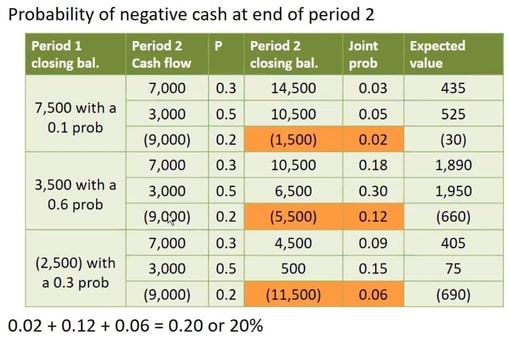

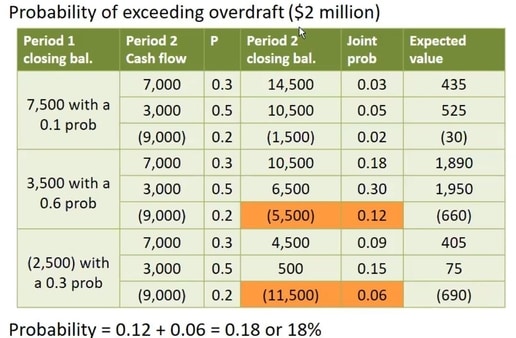

- Questions can assign probabilities to certain flows occurring

Question for Cash Flow Forecast and Un-Certainty

Question

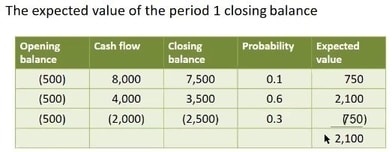

Answer

Treasury Management

A large organization will have a separate specialized treasury department typically to manage. (Where the company has all funds, its called treasury fund management, They collect every cash in one place and manage from there)

- Liquidity ( They assure sufficient cash is available)

- Short term investment

- Borrowings

- Foreign exchange risk (Risk Management Topic)

- Specialized areas such as forward contracts and futures (like derivatives, Forward, Future options)

Advantages of Centralising the Treasury Functions

- Precautionary motive accomplished on a group basis

- Profit center motivation

- Borrowing needs pooling to get better rates

- Foreign currency risk assessed on a group basis matches inflows and outflows

- Overdrafts & surplus can be netted off

- Cash pooled to get better returns

- Expertise

Dis-advantages

- Better matching to local assets

- Greater autonomy for local managers (they feel more powerful)

- Better matching to local market needs

- Opportunities for Fast, Specialised solutions

Cash Management Model’s

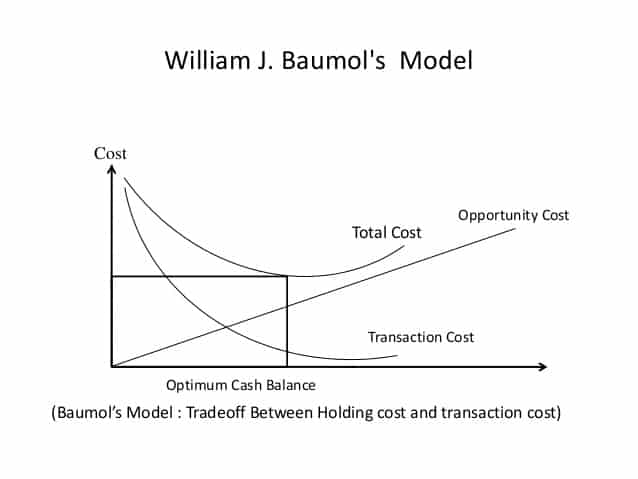

1-Baumol Cash Management Model

The Baumol Model considers a business needing a certain amount of cash per time period and works out the most economical way you raise the cash. (This model is the same as EOQ. Here use cash quantity instead inventory etc)

- If a lot of cash is raised in one go then there will be a high cost of servicing that cash (e.g Intrest), even though it might not all be needed immediately

- If cash is raised frequently in small amounts then the transaction cost will be high

- The model is analogous to the economic order quantity model for inventory where there is a compromise between high holding costs and high ordering costs

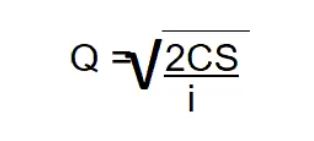

Where

- Q= The amount to be borrowed/drown down each time

- C= The cost of raising the cash e.g the cost o selling securities to receive cash

- S= Amount of cash used in each time period

- i= Intrest cost of holding cash or cash equivalent

Problems with Baumo Model

- Future cash needs are unlikely to be constant

- The cost of holding cash is likely to change frequently as interest rates fluctuate

- The cost of holding cash is likely to fluctuate with the amount of cash on deposit i.e large deposits attract higher interest

- No account is taken of keeping buffer (safe) cash

2-Miller-Orr Cash Management Model

The Miller-or Cash Management Model seeks to control the limits between the cash balance move

- Too much cash wastes money(It should be earning a return)

- Too little risk of running out of cash so increases the risk

- The cash balance is adjusted by buying and selling securities (Or moving cash to and from deposit accounts).

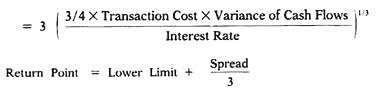

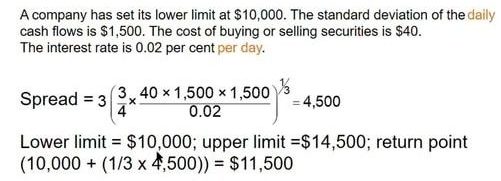

Cash is allowed to fluctuate between the upper and lower limits. When a limit is reached securities are bought or sold to restore cash to the return point. The Spread is the difference between the upper or lower limit and is given by:

- Set the lower limit e.g based on Calculation, Precautionary motive, and Experience

- Estimate the variance of the cash flows (Varience= the square of the standard deviation)

- Find interest rate and the transaction cost

- Calculate the SPREAD

- The return point is the lower limit plus 1/3 of the spread

- The upper limit is the lower limit plus the spread

The variance or stander deviation will be supplied in any question along with the other variables.

Note; This model does not set the lower limit for cash fluctuations, Also interest rate is usually the daily interest rate

Example

Investing Surplus Cash

Companies with a more modest amount should be investing surplus cash to earn interest.

- Leave enough in a current or short term deposit to ensure adequate liquidity

- Look for a return commensurate with the risk

- Avoid capital losses (Means losses on investment)

- Think carefully about the term and how long it might take to realize any investment

- Are international markets attractive?

- Do some investments require a minimum amount

Where to invest surplus cash

- Short term investments such as bank deposits, Tradeable investments,s or listed share

- Money market landing

- Certificates of deposit

- Treasury Bills

Working Capital Funding Strategies

- Working capital can be funded by a mixture of

- Short term funding

- Long term funding

- The business should be aware of the distinction between fluctuating and permanent assets

- Permanent current assets are the amount requires to meet long term minimum needs

- Fluctuating current assets are the current assets that vary according to normal business activity

- A permanent asset should be funded by long term capital fluctuating assets can be funded by short term capital

- Policy A: Conservative approach —> Most finding is long-term with little reliance on short-term finance, Despite asset often falling below what the permanent funding supports. (This policy is Safe but Wasteful)

- Policy B: Aggressive approach –> Most funding is short-term, long term capital cover non-current assets but most funding of current asset, even permanent current asset relies on short term source. (This policy is Risky but Profitable)

- Policy C: Balance approach —> Permanent current assets and non-current assets are funded by long term capital, Fluctuating current assets are funded by short term capital (Such as Overdraft)

Other Factors

Working capital Cash Management is also affected by:

- Industry Norms: For example what the normal receivables and payables periods are for the industry, straying too far from these might make the company un-competitive

- Industry type: Erratic sale implies more working capital is a need for the bad times

- The manufacturing: Long-term manufacturing time implies a high amount of work in the capital

- Management issue: For example attitude to Risk, Quality of the information system e.g if PPR buffer inventories may be needed

Read More:-…………………………….

The following are the top-rated Class 9 Math notes for students to use in preparation for their 9th-grade exams