ACCA Audit and Assurance (AA)

ACCA AA Syllabus 2023

Topic-wise Notes

- AA

What is Audit?

First of all the basic means of Audit is investigations.

Another way in accounts, this word being used Audit for the examination of Financial Statements prepared by entities annually.

- Balance sheet

- Statement of profit and loss

- Income statement

- Statement of changes in equity

- Statement of cash flow

Likewise, ACCA AA (F8) is a theoretical paper that Probably consists of 90% theory and 10% calculations.

In theory, the examiner tests the concepts of students by giving a situation, and students need the resolve that situation in different ways in different questions, like Analytical procedures, Tests of controls, internal controls

Also, other parts of the parts consist of calculations, Calculations of this part are probably from IAS-IFRS, like if the examiner explains the situation by referring to IFRS-16 then you should be attentive there is something wrong in the calculation of IFRS 16 which examiner wants you to correct this problem,

Furthermore, like assets are recorded correctly, Disposals are calculated in the right way, Depreciation treatments accounting according to the IFRS 16,

Similar to other accounting standers.

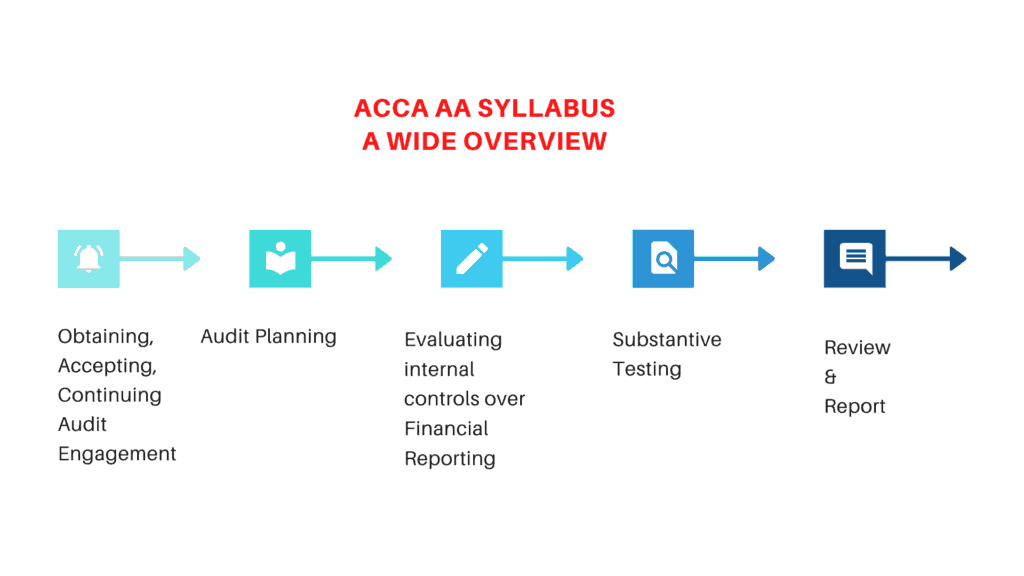

The main motive of the ACCA AA paper

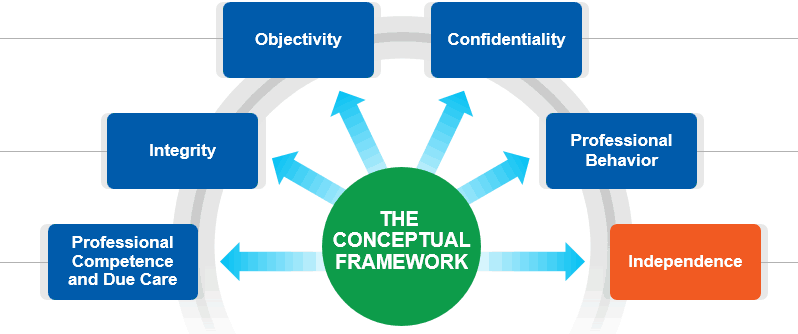

This is to develop a basic understanding and knowledge of the audit process to give an assurance engagement to a Clint by following the Professional Regulatory Framework

However, to pass AA you need to:

- Concepts regarding the audit and assurance

- what are the procedures of an audit, and how does an auditor perform his audit assignments

- Understand and evaluation of internal controls to assess the risk factors

Study Plan

Material for topic preparation: Any approved learning provider content along with the revision notes.

Material for Question practice: Past exams (Any Revision Kit- The answers on the ACCA website do not reflect the changes in the accounting and auditing standards). Please use the latest Kit (for Sept 2017 exam session) for answers.

Key preparatory recommendations:

-Attempt each question first yourself

-then read the answers

-Read the answers constructively- annotate and underline the key points that you missed, commonly used terminology, etc.

ACCA AA Practice Questions Topic Wise

| Topic | Questions |

|---|---|

| Assurance & Regulation | June 2015-Q5c Dec 12- Q2a,c June 12- Q1c |

| Accepting audit engagements | Sept/Dec Hybrid 2015-Q2 a,b Dec 2013-Q4a,b June 11 Q2b |

| Audit planning | Sept/Dec Hybrid 2015-Q2c Sept/Dec Hybrid 2015-Q4 June 2015-Q5b |

| Audit planning | June 2014-Q3a Dec 2013-Q1a,b,c June 2013-Q3 ( Ratios) |

| Audit planning | Dec 2012-Q3a,b Dec 2010-Q3 ( Ratios) |

| ICS-Sales | Dec 2014-Q5a Dec 2013-Q3 June 11- Q1a,c |

| ICS-purchases | June 2015-Q4 June 2013-Q1b,c Dec 10- Q1a,b, Q4b |

| ICS-payroll | Sept/Dec Hybrid 2015-Q5 a,b June 2014-Q1a,b Dec 2011- Q1a |

| Other IC topics | June 10- Q3b June 2015-Q2 Dec 09- Q3b June 2012- Q1a |

| Evidence and procedures | June 12- Q4a June 11- Q3a |

| Substantive-Sales and trade receivables | June 2015-Q6a and Q6biii Dec 2014-Q5b |

| Audit procedures-Inventory | Sept/Dec Hybrid 2015-Q6a, bi Dec 2014-Q6bii June 2014-Q3b Dec 2012-Q1a,b June 2012-Q4a |

| Substantive-Property, Plant & Equipment And Equity | Dec 2014-Q6bi June 2013-Q4a June 2012-Q1b,c |

| Substantive-purchases and trade payable s | June 2015-Q6bi |

| Payroll | Sept/Dec Hybrid 2015-Q5c Dec 2014-Q1 June 2014-Q1c,d |

| Intangible assets | Sept/Dec Hybrid 2015-Q6bii |

| Bank | June 2015-Q6bii June 2013-Q1d |

| Remuneration | June 2014-Q3c |

| Relying on work of others | Dec 2014-Q6a |

| Substantive practice | Dec 2013-Q1d Dec 2012-Q4b June 2012-Q4b |

| Fraud, Laws & regulations | June 2015-Q5a Dec 12- Q2b June 12- Q3a |

| Audit documentation | June 12- Q4c June 11- Q2a |

| CAATs | Dec 10- Q2c |

| Sampling | Dec 2012-Q1c June 12- Q2b |

| Going concern review | Sept/Dec Hybrid 2015-Q3 June 2014-Q5a,b,c June 2012-Q5a,b,c |

| Subsequent events review, overall review | Dec 2011-Q5a, bi, and bii Dec 2008-Q5 June 2013-Q1a Dec 2010-Q5a,b |

| Audit opinion & report | Sept/Dec Hybrid 2015-Q6c June 2015-Q3 Dec 2014-Q4 Dec 2014-Q6c June 2014-Q5d |

| Audit opinion & report | June 2013-Q5c Dec 2012-Q5 June 2012-Q5d Dec 2011-Q5biii June 2011-Q5c |

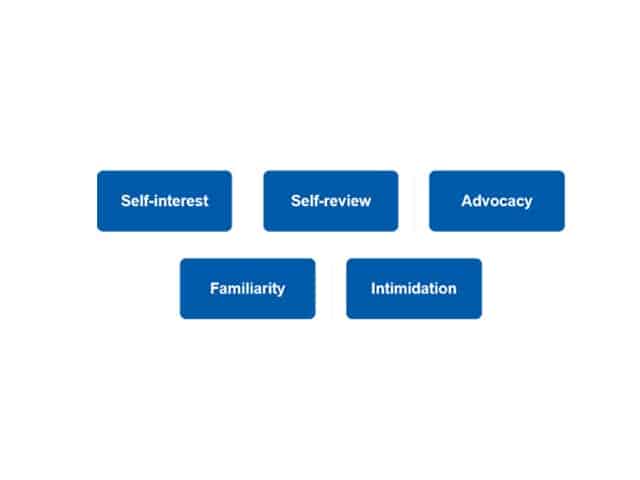

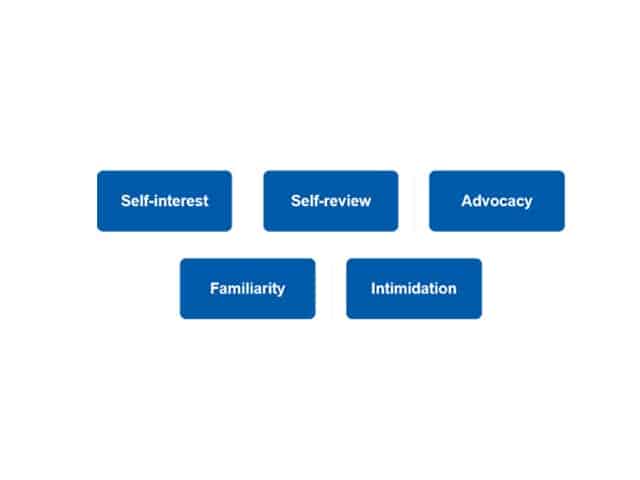

| Ethics | Sept/Dec Hybrid 2015-Q1 June 2015-Q1 June 2014-Q3d Dec 2013-Q4c June 2012-Q3b,c |

| Corporate governance | Dec 2014-Q3 |

| Internal audit | June 2014-Q4 June 2013-Q4b,c,d June 2013-Q5a,b Dec 2012-Q3c June 2012-Q1d,e June 2012-Q3d |

| Full exam paper under exam conditions ( time managed) | March/June 2016 Sept 2016 Dec 2016 March/June 2017 |

How to Pass ACCA AA

AA Video Lectures

Books & Revision Kits

AA Pass Rate

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 40% | 40% | 38% | 39% | 38% |

Find Us on Facebook

Previously Known as F8