ACCA Advanced Financial Management (AFM)

Previously known as P4 ¬ ACCA AFM Syllabus

Books & Revision Kits

AFM video lectures

AFM Pass Rate

| Dec 2018 | March 2019 | Jun 2019 | Sep 2019 | Dec 2019 |

|---|---|---|---|---|

| 41% | 35% | 38% | 38% | 33% |

ACCA Study Material Hub

ACCA is the global body for professional accountants Worldwide, with 219,000 qualified members & 527,000 students, world’s best and most highly sought

Previously known as P4 ¬ ACCA AFM Syllabus

| Dec 2018 | March 2019 | Jun 2019 | Sep 2019 | Dec 2019 |

|---|---|---|---|---|

| 41% | 35% | 38% | 38% | 33% |

Previously known as P2 ¬ SBR ACCA Notes

| Dec 2018 | March 2019 | Jun 2019 | Sep 2019 | Dec 2019 |

|---|---|---|---|---|

| 47% | 49% | 48% | 52% | 48% |

Previously known as F6 ¬ TX ACCA Syllabus

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 51% | 50% | 51% | 52% | 49% |

ACCA Financial Management (FM) – Previously Known as F9 ¬ ACCA FM Paper

First of all, The final exam in which you are going to appear will include two sections

In FM you have to practice in 3 different types of areas,

1- Simple MCQs OR OT questions (30 Marks questions)

2-OT case- A case study will be given and related 5 questions, you need to read and understand the case study and answer the related 5 questions. (30 Marks)

3-Constructive Response area: (40 Marks)

Must Practice all areas from past papers

Therefore Remember mostly students who fails a 49, They claim that they are failed by 1 mark, This is not true, Almost you were failed by 51 Marks 🙂 Keep in mind and practice very well

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 48% | 48% | 43% | 46% | 43% |

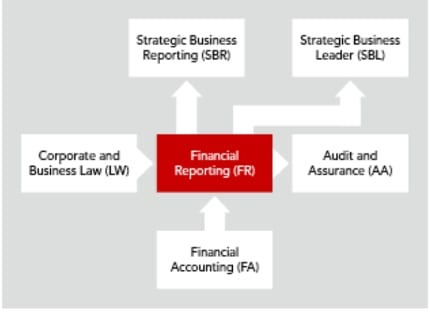

Previously Known as F7 ¬ ACCA FR Textures

Miscellaneous Topics

Financial Reporting FR (F7) is the 7th paper of ACCA & and the advanced level of FA (F3).

This paper deals with Financial accounting.

The main purpose of this paper is to build capabilities & skills in applying International Accounting Standards and theoretical framework. and interpretation of Financial Statements

FA is mainly a calculation-based paper- Examiner wants you to apply standers on different scenarios which are given in the exam paper

For Example, a question in the exam is from IFRS 16, So for the most problem examiner with the check, your knowledge and application of this stander as technically as He/She can.

But if you have a full grip on International Accounting Standers And IFRS, Then believe exam questions will be just a child’s play for you and you will pass this Exam Easily

If we calculate time per mark, it’s 1.8 Minutes per mark.

So we have

Exam time allocated 3 Hours

Passing Marks 50

The Conceptual and Regulatory Framework for Financial Reporting

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 49% | 50% | 51% | 50% | 46% |

Also, Read

How to pass ACCA FR

ACCA Exam Tips

ACCA PM Performance Management – Previously Known as F5 ¬ ACCA PM Course

Absorption Costing Vs Marginal Costing

Introduction: Performance Management (PM) is the fifth paper of ACCA, Previously known as F5.

As well this is the advanced level paper of F2, Most topics were introduced in F2, But the testing level is high in PM(F5)

First of all, The main purpose of the paper is to build basic skills related to the Management Accounting

Also, PM is a Computer-based exam, available 4 times a year, March-June-September-December

Hence For the exam timetable: Click Here

Furthermore, Mainly this is the mixed paper of the reticle and calculation, However, the major portion consists of theory,

Also, Performance Management is considered one of the toughest papers in ACCA’s Fundamental papers, with the lowest passing rate after Audit (AA), See below the official passing rate issued by the ACCA

However, with a little bit of Management in study style, you can easily pass this paper,

In PM there are four key area

As a result, you must cover the entire syllabus of PM, Similarly, practice past papers as much as you can as this is the key to success in exams,

Practice makes perfect

The total time allowed in the exam is 3 hours and 15 minutes, and you need probably perfect time management to complete the paper, this is only possible with practice and practice

So due to, details visit ACCA’s official website: Click Here

And most noteworthy below we sharing ACCA PM video lectures with you, Held by ACCA

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 42% | 38% | 39% | 38% | 38% |

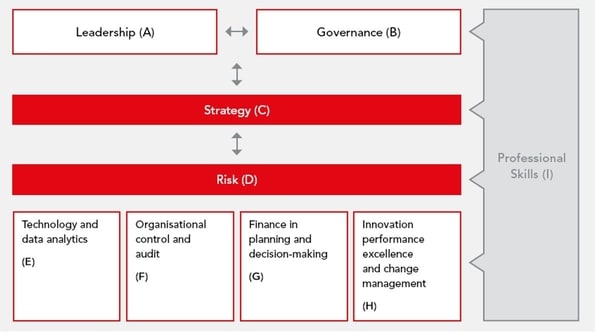

New Paper by merging P1 and P3 – ACCA SBL ACCA Course

| Dec 2018 | March 2019 | Jun 2019 | Sep 2019 | Dec 2019 |

|---|---|---|---|---|

| 48% | 46% | 51% | 49% | 46% |

ACCA AAA (Advanced Audit and Assurance) – Previously known as P7 – AAA, And ACCA

AAA Syllabus includes two sections

1: Audit of historical Financial Statements (All syllabus of AA)

| Acceptance of Audit |

|---|

| Audit planning & Risk Assessment (18-24 Marks Normally in Question No 1) |

| Audit Evidence (20-30 Marks Normally It can be tested anywhere in the paper, in any part out of 3) |

| Review (Around 15 Marks in every paper) |

2: Other Areas

Two sections in this area

| Ethic & Practice Management. (Around 20 Marks from this area) | Other Assignments (Q3 10-20 Marks Normally) |

|---|---|

| Audit Regulation | Forensic Audit |

| Code of ethics | PFI |

| Audit Quality | Social & Environment Audit |

| Advertising Professional services | Audit of performance information of public sector |

| Due diligence |

| Dec 2018 | March 2019 | June 2019 | Sep 2019 | Dec 2019 |

|---|---|---|---|---|

| 31% | 30% | 31% | 36% | 30% |

Find Us on Facebook

Topic-wise Notes

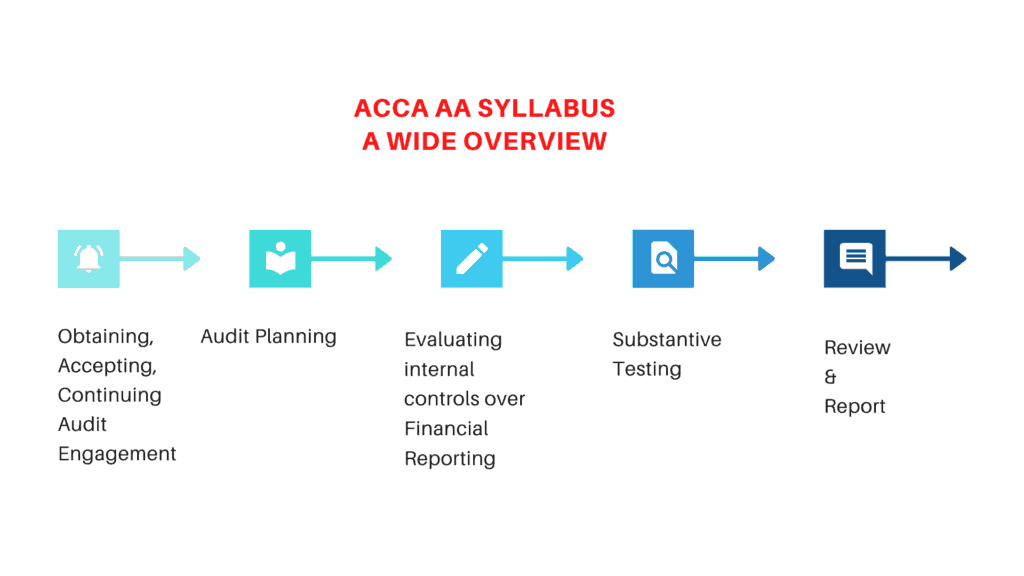

First of all the basic means of Audit is investigations.

Another way in accounts, this word being used Audit for the examination of Financial Statements prepared by entities annually.

Likewise, ACCA AA (F8) is a theoretical paper that Probably consists of 90% theory and 10% calculations.

In theory, the examiner tests the concepts of students by giving a situation, and students need the resolve that situation in different ways in different questions, like Analytical procedures, Tests of controls, internal controls

Also, other parts of the parts consist of calculations, Calculations of this part are probably from IAS-IFRS, like if the examiner explains the situation by referring to IFRS-16 then you should be attentive there is something wrong in the calculation of IFRS 16 which examiner wants you to correct this problem,

Furthermore, like assets are recorded correctly, Disposals are calculated in the right way, Depreciation treatments accounting according to the IFRS 16,

Similar to other accounting standers.

The main motive of the ACCA AA paper

This is to develop a basic understanding and knowledge of the audit process to give an assurance engagement to a Clint by following the Professional Regulatory Framework

However, to pass AA you need to:

Material for topic preparation: Any approved learning provider content along with the revision notes.

Material for Question practice: Past exams (Any Revision Kit- The answers on the ACCA website do not reflect the changes in the accounting and auditing standards). Please use the latest Kit (for Sept 2017 exam session) for answers.

Key preparatory recommendations:

-Attempt each question first yourself

-then read the answers

-Read the answers constructively- annotate and underline the key points that you missed, commonly used terminology, etc.

| Topic | Questions |

|---|---|

| Assurance & Regulation | June 2015-Q5c Dec 12- Q2a,c June 12- Q1c |

| Accepting audit engagements | Sept/Dec Hybrid 2015-Q2 a,b Dec 2013-Q4a,b June 11 Q2b |

| Audit planning | Sept/Dec Hybrid 2015-Q2c Sept/Dec Hybrid 2015-Q4 June 2015-Q5b |

| Audit planning | June 2014-Q3a Dec 2013-Q1a,b,c June 2013-Q3 ( Ratios) |

| Audit planning | Dec 2012-Q3a,b Dec 2010-Q3 ( Ratios) |

| ICS-Sales | Dec 2014-Q5a Dec 2013-Q3 June 11- Q1a,c |

| ICS-purchases | June 2015-Q4 June 2013-Q1b,c Dec 10- Q1a,b, Q4b |

| ICS-payroll | Sept/Dec Hybrid 2015-Q5 a,b June 2014-Q1a,b Dec 2011- Q1a |

| Other IC topics | June 10- Q3b June 2015-Q2 Dec 09- Q3b June 2012- Q1a |

| Evidence and procedures | June 12- Q4a June 11- Q3a |

| Substantive-Sales and trade receivables | June 2015-Q6a and Q6biii Dec 2014-Q5b |

| Audit procedures-Inventory | Sept/Dec Hybrid 2015-Q6a, bi Dec 2014-Q6bii June 2014-Q3b Dec 2012-Q1a,b June 2012-Q4a |

| Substantive-Property, Plant & Equipment And Equity | Dec 2014-Q6bi June 2013-Q4a June 2012-Q1b,c |

| Substantive-purchases and trade payable s | June 2015-Q6bi |

| Payroll | Sept/Dec Hybrid 2015-Q5c Dec 2014-Q1 June 2014-Q1c,d |

| Intangible assets | Sept/Dec Hybrid 2015-Q6bii |

| Bank | June 2015-Q6bii June 2013-Q1d |

| Remuneration | June 2014-Q3c |

| Relying on work of others | Dec 2014-Q6a |

| Substantive practice | Dec 2013-Q1d Dec 2012-Q4b June 2012-Q4b |

| Fraud, Laws & regulations | June 2015-Q5a Dec 12- Q2b June 12- Q3a |

| Audit documentation | June 12- Q4c June 11- Q2a |

| CAATs | Dec 10- Q2c |

| Sampling | Dec 2012-Q1c June 12- Q2b |

| Going concern review | Sept/Dec Hybrid 2015-Q3 June 2014-Q5a,b,c June 2012-Q5a,b,c |

| Subsequent events review, overall review | Dec 2011-Q5a, bi, and bii Dec 2008-Q5 June 2013-Q1a Dec 2010-Q5a,b |

| Audit opinion & report | Sept/Dec Hybrid 2015-Q6c June 2015-Q3 Dec 2014-Q4 Dec 2014-Q6c June 2014-Q5d |

| Audit opinion & report | June 2013-Q5c Dec 2012-Q5 June 2012-Q5d Dec 2011-Q5biii June 2011-Q5c |

| Ethics | Sept/Dec Hybrid 2015-Q1 June 2015-Q1 June 2014-Q3d Dec 2013-Q4c June 2012-Q3b,c |

| Corporate governance | Dec 2014-Q3 |

| Internal audit | June 2014-Q4 June 2013-Q4b,c,d June 2013-Q5a,b Dec 2012-Q3c June 2012-Q1d,e June 2012-Q3d |

| Full exam paper under exam conditions ( time managed) | March/June 2016 Sept 2016 Dec 2016 March/June 2017 |

| Dec 2017 | Jun 2018 | Dec 2018 | Jun 2018 | Dec 2019 |

|---|---|---|---|---|

| 40% | 40% | 38% | 39% | 38% |

Find Us on Facebook

Previously Known as F8

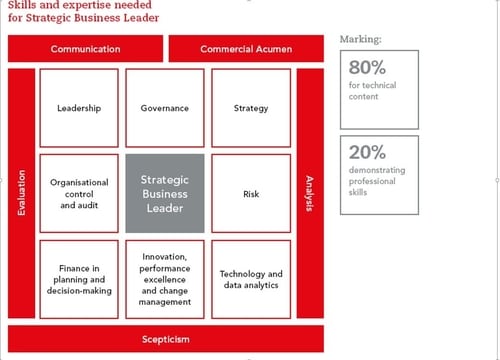

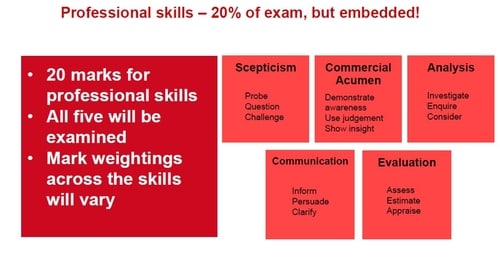

An innovative case study examination

Integrated technical, ethical, and professional skills.

A successful student should:

1.1 Being Leader

As a leader, you are expected to be able to analyze a business situation and provide and implement an appropriate, effective and sustainable solution. This Means that can

1.2 Thinking Strategically

Having a strategic perspective means that you can do the following:

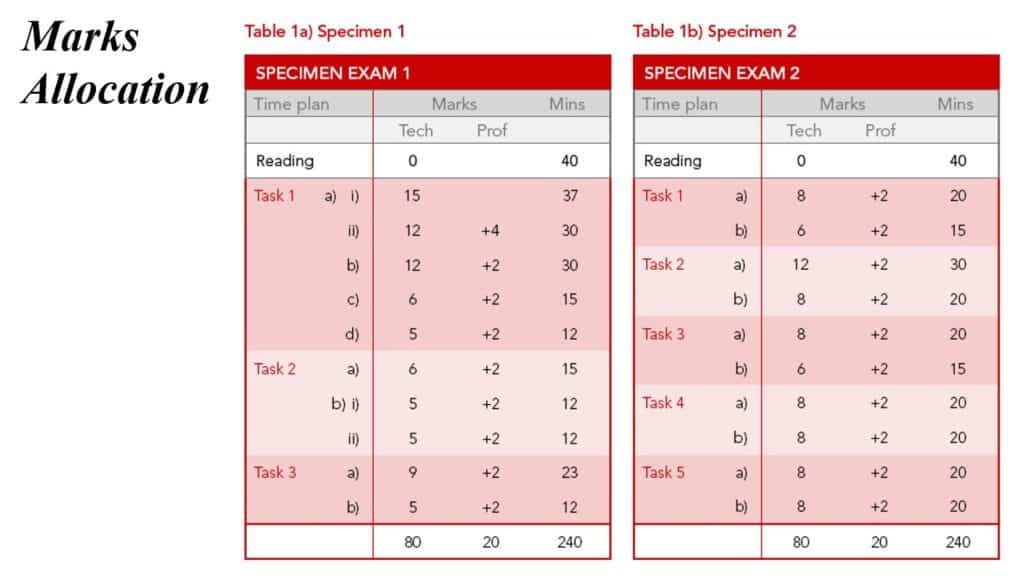

A quick guide to dividing your time in Exam

Three Phases of study for Strategic Business Leaders

Read More: ACCA Video Lectures